The local investment banks in Brazil are gaining ground in the market. With an increase in demand for private credit and a record in the emission of debt securitiesinstitutions such as Itaú e BTG are climbing the rankings, while giants such as Bank of America lose share. You will understand how these local banks take advantage of their strong presence with retail customers and market growth in order to stand out from the competition.

- Local investment banks in Brazil gain market share with debt and private credit.

- Bank of America fell to third position in revenues in Brazil.

- Itaú and BTG increased their investment banking revenues significantly.

- Local corporate bond issues reach record of R$ 378.7 billion.

- The demand for private credit is growing due to high interest rates in Brazil.

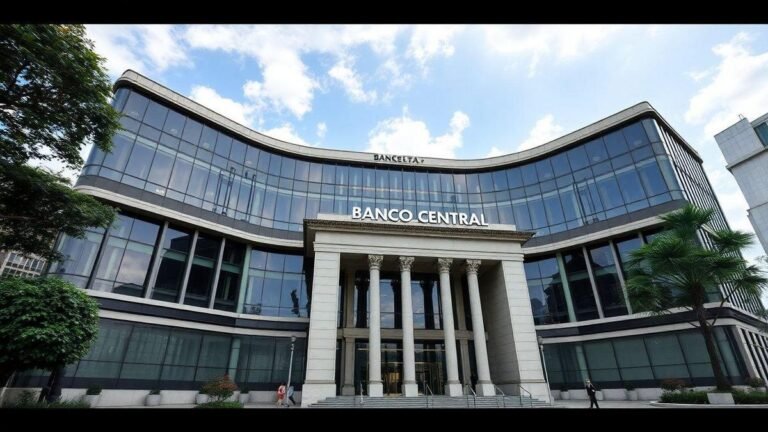

The Growth of Local Investment Banks in Brazil

The Rise of Brazilian Banks

Have you noticed how local investment banks are gaining momentum in Brazil? With the increase in private credit funds and the record issuance of debt securities, these financial institutions are gaining market share, surpassing even giants like Bank of America. This phenomenon reflects the country's economic dynamics and changes in interest rates.

Competition with foreign giants

In Dealogic's ranking of revenues up to the end of October, Bank of America fell to second place. third positionlosing ground to local banks Itaú and BTG. J.P. Morgan also saw its market share shrink. This shows how the financial landscape is changing and how Brazilian banks are adapting to stand out.

The Relationship with Retail Customers

One of the factors contributing to the success of Brazilian banks is the strong relationship with their retail clients. These clients have been investing more in Brazilian bonds, especially due to the increase in interest rates and the tax exemption. Os bancos norte-americanos, por outro lado, não têm uma presença significativa no setor de varejo no Brasil, limitando suas operações. Para entender melhor como funcionam esses investimentos, confira a seção sobre fixed income for beginners.

The Appetite of Local Banks

De acordo com Felipe Thut, que lidera a área de fixed income do Bradesco BBI, os bancos brasileiros têm um greater appetite to acquire local bonds. They can keep these papers in their portfolios for longer, offering solid guarantees for companies in market transactions. This practice has become common since 2018. To find out more about how bonds work, visit what is Treasury Direct.

Challenges in the Investment Market

Despite the growth of local banks, total investment banking commission income in Brazil fell to US$ 591 million by the end of October, a decrease of 6.1% compared to the previous year. This fall is linked to a decrease of 18% in the issuance of actionsR$ 30.8 billion, according to Bloomberg data. This indicates that although local banks are excelling, they still face challenges. To better understand the financial scenario, see the analysis on financial market.

The growth of Itaú and BTG

Itaú, for example, saw its revenue from brokerage and economic advisory services grow 51% in the first nine months of 2024. BTG, for its part, recorded a significant increase in its investment banking revenue, which more than doubled in the first half of this year. These results demonstrate the growing strength of these banks on the Brazilian financial scene. For more information on investments, visit how to invest money.

The Demand for Private Credit

The demand for private credit está em ascensão, especialmente porque a política monetária do Brasil se afasta da tendência global. Enquanto as taxas de juros estão caindo em muitas economias, no Brasil, elas estão subindo. Além disso, mudanças tributárias e o desempenho fraco de fundos multimercado e de ações têm levado os investidores a buscar alternativas em renda fixa. Para entender as diferenças entre renda fixa e variable income, confira fixed income vs. variable income.

Issuing Corporate Bonds

The issuance of local corporate bonds increased 88%, atingindo um recorde de R$ 378,7 bilhões até o início de novembro. As empresas estão aproveitando a oportunidade de vender dívidas com prêmios de crédito em níveis historicamente baixos. Cristiano Guimarães, do Itaú, destacou que a participação do banco na receita total de banco de investimento no Brasil cresceu de 12.4% to 14.7%.

The Evolution of the Local Market

The securities market in Brazil is becoming more mature, with an increasing number of structured transactions being sold to retail clients. This generates higher commissions for investment banks compared to unstructured securities offered to institutional investors. Guimarães notes that in a lucrative market, new competitors tend to emerge, which can lead to price competition. To find out more about diversifying your investments, see investment diversification.

Bank of America Recognition

Bank of America admits that its presence in the local debt securities market in Brazil is limited. However, the bank maintains a strong position in strategic products, such as advising on mergers and acquisitions and coordinating sales of shares and debt securities on the international market. Hans Lin, co-head of BofA's investment bank in Brazil, notes that the volume of mergers and acquisitions is increasing, as international investors are taking advantage of opportunities due to the weaker real.

The Increase in Acquisitions

Acquisitions of Brazilian companies by foreign investors rose 62%BTG's revenue reached US$ 35.9 billion by mid-October. BofA and Itaú have exchanged positions in the revenue ranking in recent years, with BTG maintaining a strong presence in the market.

Bradesco's growth

Bradesco is also standing out, with revenues of 27% in its capital markets and financial advisory services in the first nine months of the year. The bank rose from seventh to fifth place in Dealogic's ranking. BTG's investment banking revenue reached R$ 1.2 billion in the first half of the year, while Bradesco recorded R$ 1.16 billion in its operations.

Hiring New Talent

The demand for debt securities has been so high that Bradesco has contracted 12 executives for its investment banking area this year, as well as six people to distribute the roles. This resulted in a robust team of 55 professionals. For the first time, the bank also created a specific fixed income directorate, with Thut at the helm.

Expectations for the future

Thut believes that the bond market has tripled since 2018 and that all the big local banks are focusing more and more on this segment. He expects growth to continue next year as interest rates in Brazil continue to rise. However, he warns that the pace of growth could be slower in 2025.

Conclusion

In short, the rise of the local investment banks in Brazil is a phenomenon that cannot be ignored. With a scenario of robust growth in the demand for private credit and record issuance of debt securitiesinstitutions such as Itaú e BTG are standing out, while giants like Bank of America face challenges. A strong relationship with retail clients and a growing appetite for local bonds are factors that reinforce this trend. However, it is essential to be aware of the challenges that still persist, such as the drop in total commission revenues and the need to adapt in an evolving market.

Keep an eye on the changes and opportunities this market offers, and don't hesitate to explore the topic further. To deepen your knowledge, visit learnaboutfinance.com and discover more articles that can enrich your understanding of finance and investments.

Frequently asked questions

What is driving the growth of local banks in the investment market?

Os bancos locais estão crescendo devido a grandes fluxos de dinheiro para fundos de crédito privado e mais emissão de títulos de dívida.

How do Brazilian banks compete with US banks?

Brazilian banks are gaining ground, while US banks such as Bank of America are losing share.

Why are investors buying more Brazilian bonds?

Investors are buying more Brazilian bonds due to rising interest rates and tax exemptions in some cases.

What is the relationship between corporate debt and local banks?

Companies are issuing more debt with low credit premiums, favoring local banks in the placement of these papers.

What could change in the future for investment banks in Brazil?

Banks expect growth, but with a smaller increase in 2025, as interest rates remain high.